| [9/20 해외] FOMC의 금리인하결정과 미-중 실무협상의 진전, 글로벌 주요 증시 상승세 | |||||

|---|---|---|---|---|---|

| 번호 | 2311 | 작성일시 | 2019-09-20 | 조회수 | 13867 |

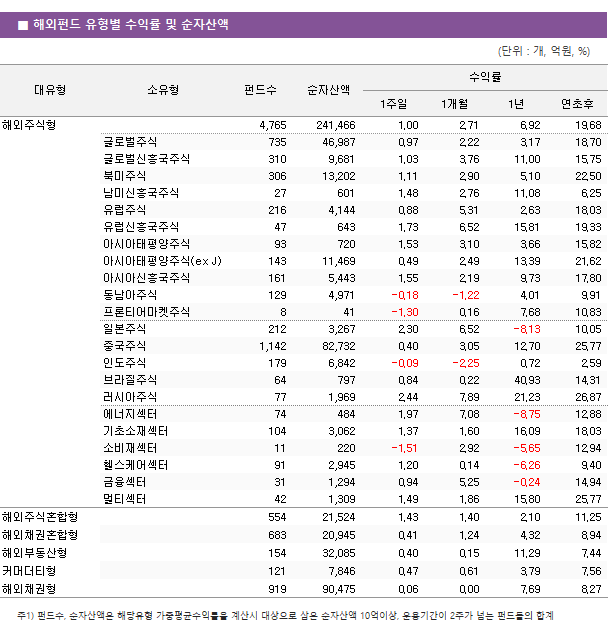

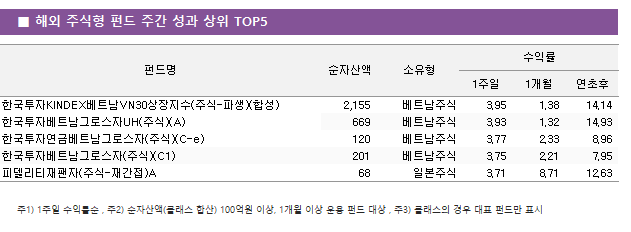

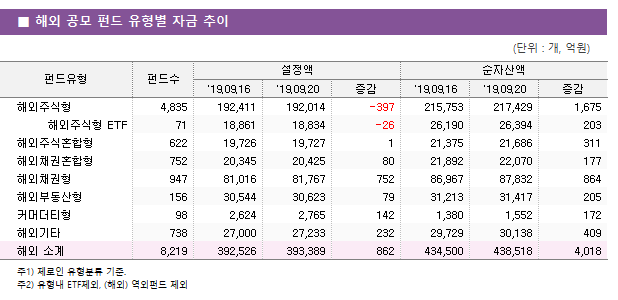

| FOMC의 금리인하결정과 미-중 실무협상의 진전, 글로벌 주요 증시 상승세 한 주간 글로벌 주요 증시는 상승세를 보였다. 다우 종합 지수는 중국산 수입품 관세 인상을 연기하며 미중 무역갈등 완화로 상승했으나 FOMC가 추가 금리인하에 신중한 입장을 보이면서 약보합 마감했다. EURO STOXX 50 지수는 사우디 석유시설 피격으로 지정학적 불확실성에 하락했었으나 이후 미-중 실무협상의 진전과 미 연준의 금리인하로 상승 전환 마감했다. 상해종합지수는 인민은행이 중기유동성지원창구(MLF) 입찰금리를 유지한 데 따른 완화정책 기대감 하락으로 약세전환 마감하였다. NIKKEI 225지수는 BOJ의 금융정책결정회의 후 발표한 성명에서 보인 추가 완화 여지에 대한 기대로 상승마감했다. 펀드평가사 KG제로인(www.Funddoctor.co.kr)이 9월 20일 오전 공시된 기준가격으로 펀드 수익률을 조사한 결과, 해외주식형 펀드는 한 주간 1.00% 상승했다. 그 중 러시아주식이 2.44%로 가장 큰 폭으로 상승을 주도했다. 섹터별 펀드에서는 에너지섹터가 1.97%로 가장 큰 상승세를 보였다.  대유형으로는 해외주식혼합형(1.43%), 커머더티형(0.47%), 해외채권혼합형(0.41%), 해외부동산형(0.40%), 해외채권형(0.06%)이 모두 플러스 수익률을 보였다.  제로인 유형분류 기준 공모 해외펀드(역외펀드 제외) 설정액은 862억원 증가한 39조 3389억원으로 집계되었다. 해외주식형 펀드의 설정액은 397억원 감소한 19조 2014억원으로 집계되었다. 해외채권형 펀드의 설정액은 752억원 증가했으며, 해외부동산형 펀드의 설정액은 79억원 증가했다. 그 외에 해외주식혼합형 펀드의 설정액은 1억원 증가했다. 소유형별로는 베트남주식 펀드의 순자산액이 639억원 증가하였고, 유럽주식 펀드의 순자산액은 50억원 감소했다.  |

|||||

| 이전글 | [9/27 국내] 美 정치적 불확실성 및 외인과 기관 동시 코스피 매도, 국내 주식시장.. |

| 다음글 | [9/20 국내] 美-中 무역갈등 완화 및 美 FOMC의 매파적 금리 전망, 국내 주식.. |